California Driver License Classes

| You May Drive… | And You May Tow… | Examples… |

|---|---|---|

| You May Drive…With a Commercial Class A License: Any legal combination of vehicles, including vehicles under Class B and Class C. | And You May Tow…any single vehicle with a Gross Vehicle Weight Rating (GVWR) of more than 10,000 pounds. any trailer bus, with endorsement OR more than 1 vehicle, with endorsement. any vehicles under Classes B and C. | Examples… |

| You May Drive…With a noncommercial Class A License: Any vehicles under Class C. Any housecar over 40 feet but not over 45 feet. | And You May Tow…travel trailers weighing over 10,000 pounds GVWR, not used for hire. fifth-wheel travel trailers weighing over 15,000 pounds, not used for hire. With a vehicle weighing 4,000 pounds or more unladen, you may tow a: livestock trailer exceeding 10,000 pounds GVWR but not exceeding 15,000 pounds GVWR if the vehicle is controlled and operated by a farmer, used to transport livestock to or from a farm, not used in commerce or contract carrier operations, and is used within 150 miles of the person’s farm. | Examples… |

| You May Drive…With a Commercial Class B License: a single vehicle with a GVWR of more than 26,000 pounds. a 3-axle vehicle weighing over 6,000 pounds. a bus (except a trailer bus), with endorsement. any farm labor vehicle, with endorsement. all vehicles under Class C. | And You May Tow…a single vehicle with a GVWR of 10,000 pounds or less. any vehicle a Class C licensed driver may tow. | Examples… |

| You May Drive…With a noncommercial Class B License: any vehicles under Class C. any housecar over 40 feet but not over 45 feet, with endorsement. With a Basic Class C License: a 2-axle vehicle with a GVWR of 26,000 pounds or less. a 3-axle vehicle weighing 6,000 pounds gross or less. a motorized scooter. any housecar 40 feet or less. A farmer or employee of a farmer may also drive: any combination of vehicles with a Gross Combination Weight Rating (GCWR) of 26,000 pounds or less if used exclusively in agricultural operations and it is not for hire or compensation. With a Commercial Class C License: Any Class C vehicle carrying hazardous materials which requires placards. The hazardous materials (HazMat) endorsement must be on the license. Drivers who transport hazardous wastes, as defined by CVC §§353 and 15278, are also required to have the HazMat endorsement. | And You May Tow…a single vehicle with a GVWR of 10,000 pounds or less including a tow dolly, if used. With a vehicle weighing 4,000 pounds or more unladen, you may tow a: trailer coach not exceeding 9,000 pounds gross. trailer coach or fifth-wheel travel trailer under 10,000 pounds GVWR when towing is not for compensation. fifth-wheel travel trailer exceeding 10,000 pounds but not exceeding 15,000 pounds GVWR, when towing is not for compensation and with endorsement. Note No passenger vehicle regardless of weight, may tow more than 1 vehicle. No motor vehicle under 4,000 pounds unladen may tow any vehicle weighing 6,000 pounds or more gross (CVC §21715). | Examples… |

| You May Drive…With a Motorcycle Class M1 License: 2-wheel motorcycle, motor-driven cycle, or motorized scooter With a Motorcycle Class M2 License: Motorized bicycle, moped, any bicycle with an attached motor, or motorized scooter. | And You May Tow…Note: Class M1 or M2 is added to any other class license after passing law and skill tests. | Examples… |

Section 1: Introduction

There is a federal requirement that each state have minimum standards for licensing of commercial drivers. The California Commercial Motor Vehicle Safety Program was enacted to improve traffic safety on our roadways. As a result, California has developed licensing and testing requirements for drivers of commercial vehicles that equals or exceeds federal standards.

This handbook provides driver license (DL) testing information for drivers who wish to have a commercial learner’s permit (CLP)/commercial driver license (CDL). This handbook does not provide information on all the federal and state requirements needed before you can drive a commercial motor vehicle (CMV). More information may be found in Title 49, Code of Federal Regulations (CFR) or the California Vehicle Code (CVC).

Who Needs a CDL

You Must Have a CDL to Operate:

- A single vehicle with a gross vehicle weight rating (GVWR) of 26,001 pounds or more.

- A combination of vehicles with a gross combination weight rating (GCWR) of 26,001 pounds or more.

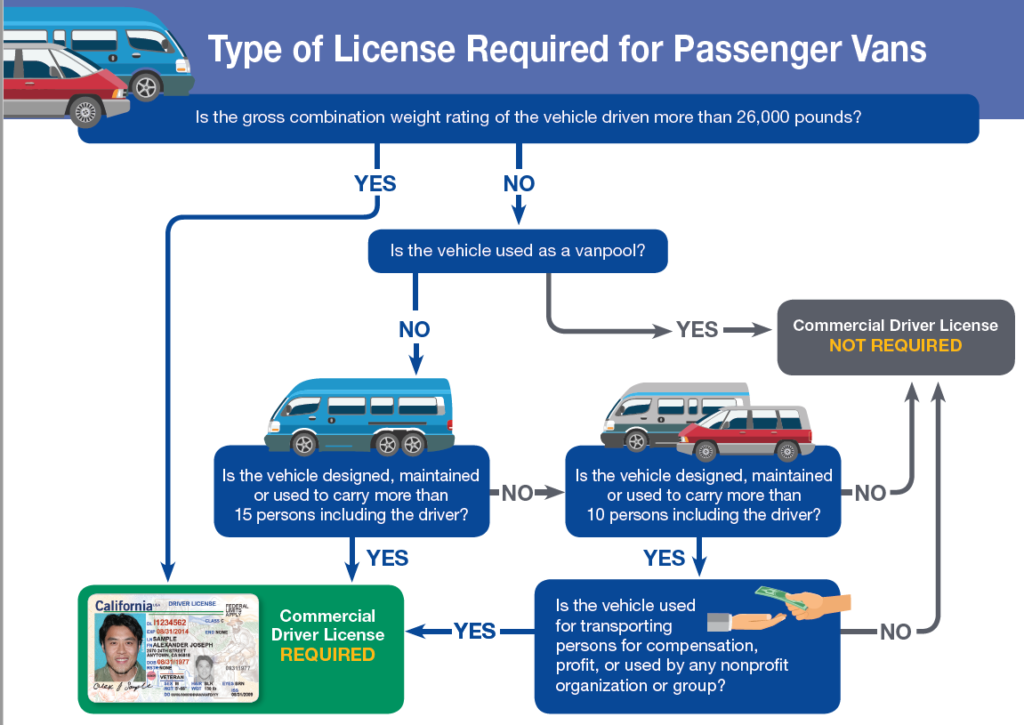

- A vehicle designed, used, or maintained for carrying more than 10 passengers, including the driver (see chart below).

- A 3-axle vehicle weighing more than 6,000 pounds.

You Must Have a CDL When:

- Towing a vehicle or trailer, which has a GVWR of 10,001 pounds or more.

- Transporting hazardous materials (HazMat), which require placards.

- Transporting HazMat, as defined in California Health and Safety Code (CHSC) §25115 and §25117.

- Towing any combination of 2 trailers or vehicle and trailer.

Horse trailers with living quarters and a GVWR over 10,000 pounds require a commercial Class A DL. Restriction 88 will be added to the DL if the truck and trailer GCWR is under 26,001 pounds.

Restriction 88–restricted to combination vehicles with a GCWR of less than 26,001 lbs. and the GVWR of the vehicle(s) being towed is in excess of 10,000 lbs.

Horse trailers are defined as property carrying vehicles and the addition of “living quarters” to a trailer does not permanently alter that vehicle for human habitation. The “living quarters” are secondary or incidental to the primary function of the vehicle, which is transporting property.

How to Get a CLP/CDL

Commercial Learner’s Permit (CLP)

The commercial instruction permit has been renamed (CLP) to comply with federal regulations. The CLP:

- Applicant must be at least 18 years of age.

- Will not be issued to an applicant until they have obtained a valid California DL, that, at a minimum, allows the applicant to operate a noncommercial Class C motor vehicle. A temporary California DL is acceptable.

- Is only valid when accompanied by the CLP holder’s valid California DL.

- Will be valid for a maximum of 180 days from the date of issuance and may be renewed for up to an additional 180 days, provided the CLP expiration date does not exceed a period of 1

–year from the initial application date. - Is limited to the following endorsements:

- Tank (N).

- Passenger (P).

- School Bus (S).

- Holder with an “N” endorsement is prohibited from operating a tank vehicle unless the tank is empty. The thank must be purged if it previously contained HazMat.

- Holder with a “P” endorsement and/or “S” endorsement is prohibited from operating a CMV with passengers, other than federal/state auditors and inspectors, test examiners, other trainees, and the accompanying CDL holder.

- Holder must wait a minimum of 14 days after initial CLP issuance to be eligible to take the skills test. The 14-day waiting period applies to classification upgrades and endorsement/restriction changes that require a skills test.

- Holder must be accompanied by a CDL holder while operating a CMV. The CDL holder must possess the appropriate class CDL and endorsements necessary to operate the CMV.

- Holder must surrender their CLP and DL to DMV prior to being issued a CDL.

Applicants Applying for a CDL:

- Must be 18 years of age.

- Must obtain a California Noncommercial Class C DL (a temporary/interim DL is acceptable). The DL must be carried to validate the CLP CFR, Title 49 §§383.5, and 383.25).

- May drive for hire within California if you are 18 years of age or older and do not engage in interstate commerce activities.

- Must be at least 21 years old to drive a commercial vehicle engaged in interstate commerce or transport HazMat or wastes (intrastate or interstate commerce) [CVC] §12515).

Provide the Following Items:

- A completed Commercial Driver License Application (DL 44C/eDL 44C) form. The eDL 44C may be completed online in advance. Signing this form means you agree to submit to a chemical test to determine the alcohol or drug content of your blood. If you refuse to sign this form, the Department of Motor Vehicles (DMV) will not issue or renew your DL.

- Your true full name

- Approved Medicals (See Section 1.2)

- An acceptable identity (birth date/legal presence) document. All applicants for an original, renewal, upgrade, or transfer of their CLP/CDL must submit proof of legal presence in the U.S. as authorized under federal law.

- If the name on your identity document is different from the name on your CDL application, you must also submit an acceptable true full name document.

- Your true full name, as shown on your identity document, will appear on your CLP/CDL.

- An acceptable identity or true full name document is produced by an issuing authority (for example, county, state, etc.).

- This document is a certified copy of the original (the original is always retained by the issuing authority) and contains an impressed seal or original stamped impression.

- The certified copy will be returned to you.

- If you make a copy of the certified copy, DMV will not accept it for identity verification.

- For more information on acceptable identity documents, visit dmv.ca.gov or call 1-800-777-0133.

- Residency (Domicile). A California driver must provide 1 document as proof of California residency for original, and upon each renewal, transfer, or upgrade. The address on the residency document must match the residence address on the DL 44C. For more information on acceptable residency documents or REAL ID Compliant CLP/CDL, visit dmv.ca.gov or call 1-800-777-0133.

- Provide proof of your social security number. Your social security number (SSN) will be verified with the Social Security Administration while you are in the office. For more information on social security documents, visit dmv.ca.gov or call 1-800-777-0133.

Note If you are applying for an original CDL (REAL ID or federal non-compliant), a social security card is the only acceptable proof of SSN.

- A Certificate of Driving Skill (DL 170 ETP). If your employer is authorized by DMV to issue such certificates. Both you and your employer must sign this form.

- The application fee. This fee is good for 12 months from the application date. The CLP is good for a maximum of 180 days and may be renewed for an additional 180 days without retaking the knowledge tests, provided the expiration date of the CLP does not exceed a period of 1-year from the application date. Scores for passed segments of the skills test are only valid during the initial issuance (first 180 days) of the CLP. Passed segments of the skills test (vehicle inspection, basic control skills, and road test) must be retaken if the CLP is renewed.

You are allowed 3 attempts to pass the knowledge test(s) and a total of 3 attempts to pass the entire skills test on a single application. If you fail any knowledge test(s) there is not a waiting period to retake. If you fail any segment of the skills tests (vehicle inspection, basic control skills, or road test), it will count as 1 failure towards the maximum 3 attempts you are allowed. EXAMPLE: Failing the vehicle inspection, basic control skills, and road test counts as a 3-time failure (or any failure combination equaling 3). However, if you are required to take the skills test for separate types of vehicles (Class A or passenger transport vehicle), you are allowed 3 skills test attempts for the Class A vehicle and 3 skills test attempts for the passenger transport vehicle. If you fail the basic skills test or the road test, there will be a retest fee charged upon your return to take the subsequent test. There is not a waiting period to retake basic control skills test(s).

| Fees subject to legislative change each January 1. | ||

|---|---|---|

| Fees subject to legislative change each January 1.If the class of license is… | and the application type is… | the fee is… |

| Fees subject to legislative change each January 1.Commercial Class A or B | an original (with or without a driving test) | $73 |

| Fees subject to legislative change each January 1.a renewal ….. | $43 | |

| Fees subject to legislative change each January 1.a commercial driving or skill retest | $33 | |

| Fees subject to legislative change each January 1.a duplicate (replacement) license | $33 | |

| Fees subject to legislative change each January 1.a name change | $27 | |

| Fees subject to legislative change each January 1.to remove a restriction(s) imposed due to vehicle size or equipment (DT required) | $73 | |

| Fees subject to legislative change each January 1.add an endorsement other than PV | $43 | |

| Fees subject to legislative change each January 1.add a passenger transport endorsement (PV) | $73 | |

| Fees subject to legislative change each January 1.add noncommercial Class A to a Class B | $43 | |

| Fees subject to legislative change each January 1.add a motorcycle license (Class M1 or M2) | $43 | |

| Fees subject to legislative change each January 1.add a firefighter endorsement | $27 | |

| Fees subject to legislative change each January 1.Commercial Class C | an original (with/without a driving test) | $43 |

| Fees subject to legislative change each January 1.a renewal | $43 | |

| Fees subject to legislative change each January 1.an upgrade: | ||

| Fees subject to legislative change each January 1.to remove an air brake restriction (DT required) | $43 | |

| Fees subject to legislative change each January 1.to add an endorsement not requiring a driving test… | $43 | |

| Fees subject to legislative change each January 1.to add a motorcycle license (Class M1 or M2) | $43 | |

| Fees subject to legislative change each January 1.to add a Firefighter endorsement | $27 | |

| Fees subject to legislative change each January 1.a commercial driving or skill retest | $33 | |

| Fees subject to legislative change each January 1.a duplicate (replacement) license | $33 | |

| Fees subject to legislative change each January 1.a name change | $27 | |

Additional Requirements

All commercial vehicle drivers must:

- Be a California resident before applying for a California CLP/CDL.

- Disclose all states in which they were previously licensed during the past 10 years and surrender all out-of-state DLs(current or expired), if any.

- Certify that they do not have a DL from more than 1 state or country.

- Self-certify what type of commercial commerce you expect to operate.

- Notify their home state DMV of any conviction which occurred in other states within 30 days of the conviction.

- Notify their employer of any conviction within 30 days of the conviction using the Report of Out-of-State Traffic Conviction by a Commercial Driver (DL 535) form.

- Notify their employer of any revocation, suspension, cancellation, or disqualification before the end of the business day following the action.

- Give their employer a 10-year employment history of commercial driving, if applying for a job as a driver.

Commercial Driver Licensing Offices

Call 1-800-777-0133 to schedule a CDL driving test at one of the following offices:

- Arleta

- Bakersfield

- Bishop

- El Centro

- Eureka

- Fontana Commercial Driving Test Center

- Fremont

- Fresno Commercial Driving Test Center

- Gardena Commercial Driving Test Center

- Lancaster

- Modesto

- Mountain View

- Rancho San Diego

- Redding

- Salinas

- San Luis Obispo

- Santa Rosa

- Santa Teresa

- Stockton

- Ukiah

- Ventura

- W Sacramento Commercial Driving Test Center

- Yuba City

For latest commercial driver licensing offices, go to www.dmv.ca.gov.

Endorsements

A special endorsement is also required to drive the following types of vehicles. The endorsement shows as a single letter on the DL.

- Placarded or marked vehicles transporting hazardous materials or wastes—(H). Any driver, regardless of the vehicle Class (A, B, or C), who wants to haul any material that has been designated as hazardous under 49 United States Code (U.S.C.) §5103 and is required to be placarded under CFR, Title 49 §172 subpart F; or any quantity of a material listed as a select agent or toxin CFR, Title 42 §73 must add an “H” endorsement to their CDL. They must pass a special knowledge examination on how to recognize, handle, and transport HazMat.Note Applicants who apply for an original Class C CDL with the “H” endorsement are required to complete the skills test.

- The Transportation Security Administration (TSA) and the U.S. Department of Transportation (DOT) require background checks on commercial drivers who are certified to transport HazMat. The background checks include a review of criminal, immigration, and FBI records. If the driver is found to represent a security threat, TSA will notify the person and the state will deny issuance of an endorsement.

- Tank vehicles (including a cement truck)—(N). Drivers of any CMV that is designed to transport any liquid or gaseous materials within a tank or tanks having an individual rated capacity of more than 119 gallons, and an aggregate rated capacity of 1,000 gallons or more that is either permanently or temporarily attached to the vehicle or the chassis must add a “N” endorsement to their CLP/CDL. A CMV transporting an empty storage container tank, not designed for transportation, with a rated capacity of 1,000 gallons or more that is temporarily attached to a flatbed trailer is not considered a tank vehicle. The endorsement applies to applicants who wish to drive a tank in Class A, B, or C CDL. Liquids in bulk cause driving control problems because the cargo is heavy, prone to shifting, and has a high center of gravity. These drivers must pass a special knowledge examination on the problems posed by large volume liquid cargos to add the endorsement to their CLP/CDL. Note Applicants applying for an original Class C CDL with the “N” endorsement are required to complete the skills test.

- Passenger transport vehicles—(P). Drivers who want to drive a vehicle having a design capacity to carry 10 or more people, including the driver, must add a “P” endorsement to their CLP/CDL. They must pass a special knowledge examination on safety considerations when transporting passengers and must pass skills tests in a passenger vehicle. The endorsement applies to applicants who want to drive a bus in any Class A, B, or C CDL. Note Applicants applying for a “P” endorsement are required to complete the skills test.

- School bus—(S). Drivers who want to drive a school bus must add an “S” endorsement to their CLP/CDL. They must pass a special knowledge examination on safety considerations when transporting passengers in a school bus and must pass skills tests in a school bus. The endorsement applies to applicants who wish to drive a school bus in any Class A or B CDL.

- Double/Triples combination—(T). Many drivers who are qualified to drive a Class A CDL may want to pull double or triple trailers. Research shows that considerable additional knowledge and skill is necessary to safely pull double and triple trailers in various traffic conditions and driving environments. Consequently, adding the “T” endorsement to drive Class A CDL is necessary if wanting to pull double or triple trailers. The CDL holder must pass a special knowledge examination on the problems associated with pulling multiple trailers. IMPORTANT: Triple trailers are not legal in California.

- Tank vehicles transporting hazardous materials or wastes—(X). (Hazardous waste must meet the definition of (CVC) §§353 and 15278.) Drivers of tank vehicles who haul HazMat or waste in amounts requiring placards must add an “X” endorsement to their CDL to show that they passed the special knowledge examinations for both tank vehicles and HazMat.

- Firefighter—(F). Required for the operation of firefighting equipment. (Not required, but optional for Class A or B CDL holders.)

Restrictions

- Restrictions may be added to a CLP/CDL based upon the type of vehicle and equipment that the driver uses for the skills test. There are 10 standardized restriction codes. Note If a CLP is issued with a “P” or “S” endorsement, it must also contain a Restriction P–No passenger in a CMV bus restriction.

- If a CLP is issued with an “N” endorsement, it must also contain a Restriction X–No cargo in a CMV tank vehicle.

- (E)–No manual transmission: If an applicant performs the skills test in a vehicle equipped with an automatic transmission, DMV must indicate on the CDL, if issued, that the person is restricted from operating a CMV equipped with a manual transmission. For the purpose of the skills test and restriction, an automatic transmission includes any transmission not operating fully on the gearshift and clutch principle.

- (K)–Intrastate only: If an applicant certifies their status as either Non-Excepted Intrastate (NA) or Excepted Intrastate (EA), the state must indicate on the CDL, if issued, that the person is restricted from operating a CMV in Interstate commerce. States may impose this restriction for reasons other than those specified above.

- (L)–No Air brake equipped CMV: If an applicant does not take or fails the air brake component of the knowledge test, or performs the skills test in a vehicle not equipped with air brakes, DMV must indicate on the CLP or CDL, if issued, that the person is restricted from operating a CMV equipped with any type of air brakes. For the purposes of the skills test and restriction, air brakes include any braking system operating fully or partially on the air brake principle.

- (M)–No Class A passenger vehicle: If an applicant applying for a “P” endorsement performs the skills test in a passenger vehicle requiring a Class B CDL, DMV must indicate on the CDL, if issued, that the person is restricted from operating a passenger vehicle requiring a Class A CDL.

- (N)–No Class A and B passenger vehicle: If an applicant applying for a “P” endorsement performs the skills test in a passenger vehicle requiring a Class C CDL, DMV must indicate on the CDL, if issued, that the person is restricted from operating a passenger vehicle requiring a Class A or B CDL.

- (O)–No tractor–trailer CMV: If an applicant performs the skills test in a combination vehicle for a Class A CDL with the power unit and towed unit connected with a pintle hook or other non fifth-wheel connection, DMV must indicate on the CDL, if issued, that the person is restricted from operating a tractor-trailer combination connected by a fifth-wheel that requires a Class A CDL. An applicant who passes a skills test using a combination vehicle that is not a truck tractor semi-trailer combination, but is otherwise equipped with a fifth-wheel, will be issued a CDL with Restriction “O”.

- (P)–No passenger in CMV bus: A CLP holder with a “P” endorsement is prohibited from operating a CMV carrying passengers, other than federal/state auditors and inspectors, test examiners, other trainees, and the CDL holder accompanying the CLP holder as prescribed by CFR, Title 49 §383.25(a)(1) of this part. (S)–A CLP holder with an “S” endorsement is prohibited from operating a school bus with passengers, other than federal/state auditors and inspectors, test examiners, other trainees, and the CDL holder accompanying the CLP holder as prescribed by CFR, Title 49 §383.25(a)(1) of this part.

- (V)–Medical variance: If DMV is notified according to CFR, Title 49 §383.73(o)(3) that the driver has been issued a medical variance, DMV must indicate the existence of such a medical variance on the Commercial Driver License Information System (CDLIS) driver record and the CDL document, if issued, using Restriction “V”.

- (X)–No cargo in CMV tank vehicle: A CLP holder with an “N” endorsement may only operate an empty tank vehicle and is prohibited from operating any tank vehicle that previously contained HazMat that has not been purged of any residue.

- (Z)–No full air brake equipped CMV: If an applicant performs the skills test in a vehicle equipped with air over hydraulic brakes, DMV must indicate on the CDL, if issued, that the person is restricted from operating a CMV equipped with any braking system operating fully on the air brake principle. For the purposes of the skills test and restriction, air over hydraulic brakes includes any braking system operating partially on the air brake and partially on the hydraulic brake principle.

CDL Exceptions

Exceptions to the CDL requirements are:

- Drivers exempted under CHSC§25163.

- Drivers operating a vehicle in an emergency situation at the direction of a peace officer.

- Drivers who tow a fifth-wheel travel trailer over 15,000 pounds GVWR or a trailer coach over 10,000 pounds GVWR, when the towing is not for compensation. Drivers must have a noncommercial Class A DL.

- Drivers of housecars over 40 feet but not over 45 feet, with endorsement.

- Non-civilian military personnel drovers operating military vehicles.

- Implement of husbandry operators who are not required to have a DL.

- Vanpool drivers

Special Certificates

Special certificates may sometimes be required in addition to a CDL, depending on the type of vehicle or load you carried.

Note It is unlawful to drive a school bus or transit vehicle while using a wireless (cell) telephone for non-work purposes. Emergency calls to law enforcement, a health care provider, fire department, or other emergency services are permitted.

Apply at DMV Field offices for the Following Certificates:

Ambulance Driver Certificate—required for driving an ambulance used commercially in emergency service (CVC §2512). Persons who have an ambulance driver certificate must submit a copy of the Medical Examination Report (MER) form MSCA-5875 and Medical Examiner’s Certificate (MEC) form MCSA-5876 to DMV every 2 years.

Hazardous Agricultural Materials (HAM) Certificate*— exempts persons who transport hazardous waste or placarded loads from CDL requirements if the:

- Person is at least 21 years of age.

- Person is employed in an agricultural operation.

- Load is not being transported for compensation.

- Vehicle is owned or leased by a farmer.

- Person has completed a HAM program approved by CHP. Although the person who qualifies for a HAM is not required to have a CDL, CMV penalties and sanctions will apply.

- Person submits a copy of the MER and MEC or Health Questionnaire (DL 546) (PDF) form(s) to DMV every 2 years.

- Person operates a vehicle which is an implement of husbandry or requires a noncommercial Class C DL and does not exceed 50 miles from one point to another.

Verification of Transit Training (VTT) Document—requires drivers of transit bus vehicles to comply with specified training requirements. Transit bus vehicles provide the public with regularly scheduled transportation for which a fare is charged (does not include general public paratransit vehicles). Drivers who have a school bus driver certificate or school pupil activity bus certificate do not need a VTT.

Apply at CHP Offices for the Following Certificates:

General Public Paratransit Vehicle (GPPV) Certificate*— required for any person who drives:

- A vehicle which carries not more than 24 persons, including the driver, and provides local transportation to the general public (for example, Dial-A-Ride) (CVC §§336 and 12523.5).

- Pupils at or below the 12th grade level to or from a public or private school or school activity.

- Vehicles used in the exclusive transportation of disabled persons.

School Bus Driver Certificate*— required for any person who drives a bus for any school district or other party carrying public or private pupils (CVC §§545, 12517, 12522, 34500, and 34501.5). A school bus driver must also have an “S” endorsement on their CDL. School bus drivers 65 years of age and older must submit annual MER and MEC forms to DMV (CVC §12517.2).

School Pupil Activity Bus Certificate (SPAB)*— required for any person who drives a bus for any school district or any other party carrying public or private pupils for school-related activities (CVC §§546 and 12517).

Farm Labor Vehicle Certificate*— required for any person who drives farm labor trucks and buses (CVC §§322 and 12519).

Note: The driver and all passengers in a farm labor vehicle are required to use seat belts.

Youth Bus Certificate*— required for any person who operates any bus, other than a school bus, which carries not more than 16 children and the driver to or from a school, to an organized non-school related activity, or to and from home (additional CHP training required) (CVC §§680 and 12523).

Tow Truck Driver Certificate*— required for drivers in emergency road service organizations that provide freeway service patrol operations pursuant to an agreement or who contract with a specified public transportation planning entity (traffic commission).

Vehicle for Developmentally Disabled Persons (VDDP)*— required for any person who operates a vehicle for a business or nonprofit organization or agency whose primary job is to transport for hire persons with developmental disabilities (California Welfare and Institutions Code §4512(A) and CVC §12523.6).

*Drivers subject to commercial driver sanctions.

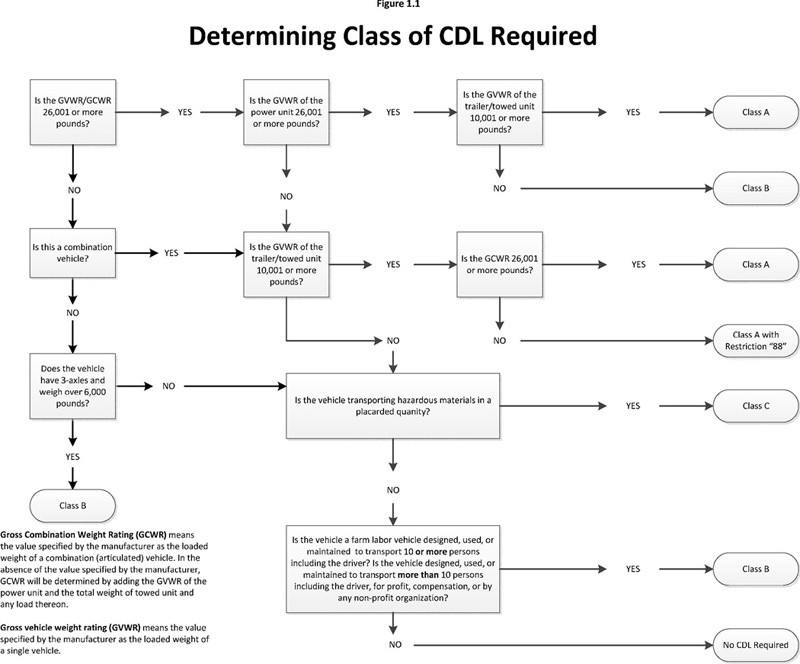

General

To get a CDL, you must pass both the knowledge and skills tests. This handbook is designed to help you pass the tests. This handbook is not a substitute for a truck driver training class or program. Formal training is the most reliable way to learn the many special skills required for safely driving a large CMV and becoming a professional driver in the trucking industry. Figure 1.1 will help you determine if you need a CDL.

1.1 Commercial Driver License Tests

1.1.1 – Knowledge Tests

The commercial knowledge tests are available in English, Arabic, Chinese, Punjabi, Russian, and Spanish. All knowledge tests administered by DMV that are required to be taken by a CDL applicant or cardholder must be taken using the Automated Knowledge Testing equipment (AKTE).

You must take 1 or more knowledge tests, depending on what class of license and what endorsements you need. If you are adding an endorsement, but not upgrading to a higher classification, DMV will waive all knowledge and endorsement tests completed or waived on the previous application, including HazMat, if the new application is started within 12 months of the previous renewal date or original CDL issue date. CDL knowledge tests include:

- The general knowledge test, required to be taken by all applicants.

- The passenger transport test, required to be taken by all bus driver applicants.

- The air brakes test, required to be taken by drivers of vehicles with air brakes, including air over hydraulic brakes..

- The combination vehicles test, required if you want to drive combination vehicles.

- The hazardous materials test, required if you want to haul hazardous materials as defined in CFR, Title 49 §383.5. To obtain this endorsement, you must pass a Transportation Security Administration (TSA) background check.

- The tank vehicle test, required if you want to haul any liquid or gaseous materials in a tank or tanks having an individual rated capacity of more than 119 gallons and an aggregate rated capacity of 1,000 gallons or more that is either permanently or temporarily attached to the vehicle or chassis.

- The doubles/triples test, required if you want to pull double or triple trailers. (Triple trailers are not legal in California.)

- The school bus test, required if you want to drive a school bus.

- The firefighter endorsement test, required to operate firefighting equipment. (Not required but optional for Class A or B CDL holders.)

Note Allow for 2-3 hours if taking all tests. Your knowledge and/or endorsement test(s) will not be returned to you.

You may take the knowledge test at any DMV field office. Office hours vary. Visit dmv.ca.gov or call 1-800-777-0133 to make an appointment.

Use of Testing Aids Are Prohibited

The use of testing aids is strictly prohibited during the knowledge test. This includes, but is not limited to: the California Commercial Driver Handbook, cheat sheets, or electronic communication devices such as a cell phone, hand-held computer, watch, etc.

If any testing aid(s) or a substitute test taker is used during the knowledge test, the knowledge test will be marked as a “failure.” An action may also be taken by DMV against your driving privilege or the driving privilege of anyone else who assists the applicant in the examination process.

During the vehicle inspection test, formerly known as pre-trip, DMV does not allow the use of testing aids, other than the vehicle inspection guide (Section 11) in this handbook. If you are caught using anything other than the inspection guide, the commercial skills test will be marked as a failure. The use of electronic devices, such as cell phones, blue tooth, CB radios, Apple watch, etc., is prohibited during the commercial skills test. In addition, people waiting in the testing vicinity are prohibited from using hand signals and shouting instructions. If this occurs, the test will be discontinued and be marked as a commercial skills test failure. If markings are found on the vehicle being used for the test to help with passing the vehicle inspection or basic control skills test, formerly known as skills test, including but not limited to: writing on the vehicle, tape, paint markings that do not appear like they belong, or markings on the curbs, walls, or trees that would help the applicant maneuver the vehicle for the basic control skills test, the test will be discontinued and marked as a failure.

The use of any recording device, including a video event recorder (dash cam), is prohibited during any commercial skills test. A dash cam is a device that continuously records in a digital loop, recording audio and/or video, but saves audio and/or video only when triggered by an unusual motion or crash or when the vehicle is operated to monitor driver performance. If the vehicle is equipped with a recording device, it must be powered off or the visual and/or audio recording features must be disabled. If the recording device cannot be powered off or disabled, which is typical for a CMV, the applicant must block the recording device, so there is no visual and/or audio recording during the road test.

1.1.2 – Skills Tests

If you pass the required knowledge test(s), you can take the CDL skills tests. There are 3 types of general skills tests that you are required to pass: vehicle inspection, basic control skills, and road test. formerly known as drive test. You must take these tests in the type of vehicle for which you wish to be licensed. Any vehicle that has components marked or labeled cannot be used for the vehicle inspection test. All skills test must be conducted in English. An interpreter is prohibited for the CDL skills test.

Vehicle Inspection Test. You will be tested to see if you know whether your vehicle is safe to drive. You will be asked to do a vehicle inspection and explain to the examiner what you would inspect and why. This test takes approximately 40 minutes. If you do not pass the vehicle inspection test, the other tests will be postponed. There is no additional fee for retaking the vehicle inspection test on the same application. See Section 11 for vehicle inspection test information.

Basic Control Skills Test. You will be tested on your skill to control the vehicle. You will be asked to move your vehicle forward, backward, and turn it within a defined area. These areas may be marked with traffic lanes, cones, barriers, or something similar. The examiner will tell you how each control test is to be done. You will be scored on your ability to properly perform each exercise. This test takes approximately 30 minutes. Failure of any skill test ends the test. A retest fee is due for each basic control skills retest. See Section 12 for skill test information.

Road Test. You will be tested on your skill to safely drive your vehicle in a variety of traffic situations on a DMV-specified route. The situations may include left and right turns, intersections, railroad crossings, curves, up and down grades, single or multi-lane roads, streets, or highways. The examiner will tell you where to drive. The test takes approximately 45–60 minutes. If you fail the road test, a retest fee is charged for each additional road test. See Section 13 for road test information.

A road test is required:

- For an original CDL.

- To remove a restriction placed on your CDL because of vehicle size or equipment.

- To add a “P” or “S” endorsement.

- To renew a CDL expired for more than 2 years.

CDL Restrictions

Your CDL will be restricted to the type of vehicle you use for the driving test. For example, if your test vehicle does not have air brakes, you will be restricted to driving vehicles without air brakes. If your passenger transport vehicle carries 15 persons or less including the driver, you will be restricted to driving a small size bus.

Troops to Trucks

The Troops to Trucks program allows DMV to waive the CDL skills test for qualified military service members who are employed, or were within the last year, in a military position requiring the operation of a military motor vehicle equivalent to a CMV on public roads and highways. Qualified applicants must submit a completed CDL Certification for Military Waiver of CDL Driving Test (DL 963) (PDF) form, and a Commanding Officer’s Certification of Driving Experience (DL 964) (PDF) form, in addition to any other documents required to apply for a CDL.

These forms are available at dmv.ca.gov. Active duty members will need to provide their military identification (ID), while veterans will need to provide a Certificate of Release or Discharge from Active Duty (DD Form 214), which shows their discharge was within the last year.

Note The CDL skills test will not be waived for an “S” and/or “P” endorsement.

Figure 1.2 details which sections of this handbook you should study for each particular class of license and each endorsement.

| WHAT SECTIONS SHOULD YOU STUDY? | ||||||||

|---|---|---|---|---|---|---|---|---|

| Sections to Study | WHAT SECTIONS SHOULD YOU STUDY?License Type | Sections to StudyEndorsement | ||||||

| WHAT SECTIONS SHOULD YOU STUDY?Class A | Sections to StudyClass B | Class C | Hazardous Materials | Double / Triple | Tank Vehicles | Passenger | School Bus | |

| 1 | WHAT SECTIONS SHOULD YOU STUDY?X | Sections to StudyX | 1 X | |||||

| 2 | WHAT SECTIONS SHOULD YOU STUDY?X | Sections to StudyX | 1 X | 2 | X | X | X | |

| 3 | WHAT SECTIONS SHOULD YOU STUDY?X | Sections to StudyX | 1 X | 2 | 3 | |||

| 4 | WHAT SECTIONS SHOULD YOU STUDY? | Sections to Study | 1 | 2 | 3 | 4 | X | |

| 5* | WHAT SECTIONS SHOULD YOU STUDY?X | Sections to StudyX | 1 X | 2 | 3X | 4 | 5* | |

| 6 | WHAT SECTIONS SHOULD YOU STUDY?X | Sections to Study | 1 | 2 | 3X | 4X | 5* | 6 |

| 7 | WHAT SECTIONS SHOULD YOU STUDY? | Sections to Study | 1 | 2 | 3X | 4 | 5* | 6 |

| 8 | WHAT SECTIONS SHOULD YOU STUDY? | Sections to Study | 1 | 2 | 3 | 4X | 5* | 6 |

| 9 | WHAT SECTIONS SHOULD YOU STUDY? | Sections to Study | 1 | 2X | 3 | 4X | 5* | 6 |

| 10 | WHAT SECTIONS SHOULD YOU STUDY? | Sections to Study | 1 | 2 | 3 | 4 | 5* | 6X |

| 11 | WHAT SECTIONS SHOULD YOU STUDY?X | Sections to StudyX | 1 X | 2 | 3 | 4 | 5*X | 6X |

| 12 | WHAT SECTIONS SHOULD YOU STUDY?X | Sections to StudyX | 1 X | 2 | 3 | 4 | 5*X | 6X |

| 13 | WHAT SECTIONS SHOULD YOU STUDY?X | Sections to StudyX | 1 X | 2 | 3 | 4 | 5*X | 6X |

| *Study Section 5 if you plan to operate vehicles equipped with air brakes. | ||||||||

Figure 1.2 – What to Study

1.2 – Medical Documentation Requirements

CDL drivers in interstate commerce and drivers applying for, or who hold, a certificate to drive a School Bus, School Pupil Activity Bus, Youth Bus, General Public Paratransit Vehicle, or Farm Labor Vehicle must use medical examiners listed on the National Registry of Certified Medical Examiners (National Registry). The National Registry is a federal program establishing requirements for healthcare professionals that perform physical qualification examinations for CMV drivers. This program was developed to improve highway safety and driver health by requiring medical examiners to be trained and certified so they can determine effectively whether a commercial driver’s medical fitness for duty meets federal standards.

If you are required to have a CDL as part of your job, your employer shall pay the cost of the examination unless it was performed before you applied for the job California Labor Code (CLC) §231)).

CDL drivers (interstate or intrastate) who successfully pass a commercial medical examination, will submit to DMV a valid (original or copy) MER and MEC form when applying for an original CLP or CDL or updating an existing medical expiration date. School bus drivers 65 years of age and older must submit a new medical report to DMV every year (CVC §12517.2(a)(b)).

MER and MEC forms completed by a U.S. licensed doctor of medicine (MD), doctor of osteopathy (DO), licensed physician assistant (PA), advanced practice registered nurse (APRN), or doctor of chiropractic (DC) who is listed on the National Registry of Certified Medical Examiners as clinically competent to perform the medical examination, must be given to DMV with your original application for a CLP or CDL. The MER and MEC forms must be dated within the last 2 years.

When submitting the MER, you are only required to submit pages 1–4. Page 5 of the MER form addresses meeting medical standards with a state variance. A DMV variance would exempt a driver from the federal physical standards. California does not have any variances or exemptions from the federal physical standards.

The medical examiner must complete and sign the MEC form for you to carry when you are driving commercially. You can be given a citation for driving out of class if you drive a CMV after your MEC expires.

Any noncommercial driver previously required to submit a Medical Examination Report (DL 51), ambulance drivers, van pool drivers, and Freeway Service Patrol tow truck drivers, are required to submit an MER and MEC form. A DL 51 in no longer acceptable.

A commercial driver who does not pass the medical examination may qualify for a California intrastate restricted Medical Certificate (DL 51B). These drivers must submit a MER form to DMV showing they did not pass the medical examination in order to be considered for an intrastate restricted medical certificate.

You may take the completed MER and MEC form to a DMV field office to be updated. You may also mail the MER and MEC form, at least 4 weeks prior to the expiration of your previous medical to:

Department of Motor Vehicles

CDL Unit, MS G204

PO Box 944278

Sacramento, CA 94244-2780

1.2.1 – Interstate or Intrastate Commerce

CFR, Title 49 §383.71 requires CDL drivers to disclose the type of commercial operation they are engaged in:

Non-Excepted Interstate (NI): Operates or expects to operate a CMV in interstate commerce and subject to and meets the qualification requirements under CFR, Title 49 §391. The license does not restrict the transport, origination, or destination of the load to be transported.

- Interstate commerce means trade, traffic, or transportation in the U.S. that is between:

- A place in a state and a place outside such state (including a place outside the U.S.).

- Two places in the state through another state or a place outside of the U.S.

- Two places in the state as part of trade, traffic, or transportation originating or terminating outside the state or U.S.

Non-Excepted Intrastate (NA): Operates or expects to operate in intrastate commerce and required to meet the qualification requirements under CFR, Title 49 §391. The cargo and passengers must originate and end in California. While driving commercially you may not cross state or international borders.

- Intrastate commerce means trade, traffic, or transportation in the U.S. that is:

- Between two places in the state as part of trade, traffic, or transportation originating or terminating inside the state. Note If you self-certify as operating NA (Non-Excepted Intrastate) your CDL card and driver record will reflect a CDL Intrastate Only Restriction (40/K).

Excepted Interstate (EI): California does not issue a CDL that is excepted from driver qualification requirements.

Excepted Intrastate (EA): California does not issue a CDL that is excepted from driver qualification requirements.

- Excepted and Non-Excepted Licensing

- Some states issue a CDL that does not require drivers to meet the qualifications outlined in CFR, Title 49 §391. Those drivers are considered “excepted” drivers. California does not issue that kind of DL.

- All drivers licensed by California to drive CMVs are non-excepted drivers.

IMPORTANT: You may be engaged in interstate commerce even if your vehicle does not leave the state. DMV strongly recommends a driver certify a driving type of non-excepted interstate (NI) if you meet the federal qualifications and there is any chance you might operate a CMV in interstate commerce.

1.3 – CDL Disqualifications

1.3.1 – General

You may not drive a CMV if you are disqualified for any reason.

1.3.2 – Alcohol, Leaving the Scene of an Accident, and Commission of a Felony

It is illegal to operate a CMV if your BAC is .04 percent or more. If you operate a CMV, you shall be deemed to have given your consent to alcohol testing.

You will lose your CDL for at least 1 year for a first offense for:

- Driving a CMV if your BAC is .04 percent or higher.

- Driving a CMV under the influence of alcohol.

- Refusing to undergo blood alcohol testing.

- Driving a CMV while under the influence of a controlled substance.

- Leaving the scene of an accident involving a CMV.

- Committing a felony involving the use of a CMV.

- Driving a CMV when the CDL is suspended/revoked.

- Causing a fatality through negligent operation of a CMV.

You will lose your CDL for at least 3 years if the offense occurs while you are operating a CMV that is placarded for HazMat.

You will lose your CDL for life for a second offense.

You will lose your CDL for life if you use a CMV to commit a felony involving controlled substances.

You will be put out of service for 24 hours if you have any detectable amount of alcohol under .04 percent.

1.3.3 – Serious Traffic Violations

Serious traffic violations are excessive speeding (15 miles per hour [mph] or more above the posted limit), reckless driving, improper or erratic lane changes, following a vehicle too closely, traffic offenses committed in a CMV in connection with fatal traffic accidents, driving a CMV without obtaining a CDL, or having a CDL in the driver’s possession, and driving a CMV without the proper class of CDL and/or endorsements.

You will lose your CDL for at least:

- 60 days for 2 serious traffic violations within a 3-year period involving a CMV.

- 120 days for 3 or more serious traffic violations within a 3-year period involving a CMV.

1.3.4 – Violation of Out-of-Service Orders

You will lose your CDL for at least:

- 90 days for your first violation of an out-of-service order.

- 1 year for 2 violations of an out-of-service order in a 10-year period.

- 3 years for 3 or more violations of an out-of-service order in a 10-year period.

1.3.5 – Railroad-Highway Grade Crossing Violations

You will lose your CDL for at least:

- 60 days for your first violation.

- 120 days for your second violation within a 3-year period.

- 1 year for your third violation within a 3-year period.

These violations include violation of a federal, state, or local law, or regulation pertaining to one of the following 6 offenses at a railroad-highway grade crossing for:

- Drivers who are not required to always stop, failing to stop before reaching the crossing if the tracks are not clear.

- Drivers who are not required to always stop, failing to slow down and check that the tracks are clear of an approaching train.

- Drivers who are always required to stop, failing to stop before driving onto the crossing.

- All drivers, failing to have sufficient space to drive completely through the crossing without stopping.

- All drivers, failing to obey a traffic control device or the directions of an enforcement official at the crossing.

- All drivers, failing to negotiate a crossing because of insufficient undercarriage clearance.

1.3.6 – Hazardous Materials Endorsement Background Check and Disqualifications

If you require a HazMat endorsement, you will be required to submit your fingerprints and be subject to a background check.

You will be denied or will lose your HazMat endorsement if you:

- Are not a lawful permanent resident of the U.S.

- Renounce your U.S. citizenship.

- Are wanted or under indictment for certain felonies.

- Have a conviction in military or civilian court for certain felonies.

- Have been adjudicated as lacking mental capacity or involuntarily committed to a mental health facility as specified in CFR, Title 49 §1572.109.

- Are considered to pose a security threat as determined by the TSA.

- For more information, visit universalenroll.dhs.gov or call 1-855-347-8371.

1.3.7 – Traffic Violations in Your Personal Vehicle

- The Motor Carrier Safety Improvement Act (MCSIA) of 1999 requires a CDL holder to be disqualified from operating a CMV if the CDL holder has been convicted of certain types of moving violations in their personal vehicle.

- If your privilege to operate your personal vehicle is revoked, canceled, or suspended due to violations of traffic control laws (other than parking violations), you will also lose your CDL driving privileges.

- If your privilege to operate your personal vehicle is revoked, canceled, or suspended due to alcohol, controlled substance, or felony violations, you will lose your CDL for 1 year. If you are convicted of a second violation in your personal vehicle or CMV, you will lose your CDL for life.

- If your license to operate your personal vehicle is revoked, canceled, or suspended, you may not obtain a “hardship” license to operate a CMV.

1.3.8 – Violation Point Counts

Convictions that occur while you are driving a CMV or CDL holder are retained on your driving record as listed below:

- Major violations and disqualification actions, 55 years.

- Out-of-service violations and disqualification actions, 15 years.

- Accidents, serious violations, and disqualification actions, 10 years.

- Railroad grade crossings and disqualification actions, 4 years.

- Minor convictions, 3 years.

A traffic accident for driving unsafely counts as 1 point. Any accidents you contributed to or were responsible or at fault for, are normally counted as 1 point. If you are convicted of reckless driving, driving under the influence of alcohol and/or drugs, or hit-and-run, these violations count as 2 points.

You will lose your privilege to drive if you are considered a negligent operator of a CMV when your driving record shows the following point counts:

- 4 points in 12 months

- 6 points in 24 months

- 8 points in 36 months

You may be entitled to a higher point count (6, 8, or 10 points) if you request and appear for a hearing and if 4, 6, or 8 points were not obtained in a noncommercial Class C vehicle.

A violation received in a CMV carries one and one-half times the point count. A Class A or B driver who does not have a special certificate or endorsement may be allowed 2 additional points before being considered a negligent operator.

Convictions reported by other states are added to your driving record and may result in CDL sanctions. If you have an out-of-state CDL, any conviction while operating in California will be reported to your home state.

Note When a commercial driver is cited in a noncommercial vehicle, the driver may be eligible to attend traffic school. (CVC §42005(c)).

1.3.9 – Violation of Hands Free or Texting Law

Regardless of what type of vehicle you are in at the time of violation, you will lose your CDL for at least:

- 60 days for your second violation of the cell phone hands free or texting law within a 3-year period and receive 1 point on your driving record.

- 120 days for your third and subsequent violations of the cell phone hands free or texting law within a 3-year period and receive 1 point on your driving record.

1.4 – Other CDL Rules

Other federal and state rules that affect drivers operating CMVs in all states. You must:

- Notify your motor vehicle licensing agency within 30 days if you are convicted in any other jurisdiction of any traffic violation (except parking). This is true no matter what type of vehicle you were driving.

- Notify your employer within 2 business days if your license is suspended, revoked, or cancelled, or if you are disqualified from driving.

- No one can drive a CMV without a CDL. The court’s action may involve a fine or require you to serve jail time for breaking this rule.

- If you have a HazMat endorsement, you must notify and surrender your HazMat endorsement to the state that issued your CDL within 24 hours of any conviction or indictment in any jurisdiction (civilian or military) in which you were found not guilty by reason of insanity of a disqualifying crime listed in CFR, Title 49 §1572.103, adjudicated as lacking mental capacity, involuntarily committed to a mental health facility as specified in CFR, Title 49 §1572.109, or you renounce your U.S. citizenship.

- Your employer may not let you drive a CMV if you have more than 1 license or your CDL is suspended or revoked. The court’s action may involve a fine to the employer or require the employer to serve jail time for breaking this rule.

- All states are connected to one computerized system to share information about CDL drivers. The states will check drivers’ history records to be sure that drivers do not have more than 1 CDL.

- You are not allowed to hold a mobile telephone to conduct a voice communication or dial a mobile telephone by pressing more than a single button when driving.

- You are not allowed to send or read text messages while driving.

- You must be properly restrained by a safety belt at all times while operating a CMV. The safety belt design holds the driver securely behind the wheel during an accident, helps the driver control the vehicle, and reduces the chance of serious injury or death. If you do not wear a safety belt, you are 4 times more likely to be fatally injured if you are thrown from the vehicle.

1.4.1 – State Laws and Rules

All CDL drivers must know the state laws limiting the size and weight of vehicles and loads. All CMVs must stop at locations posted for CHP testing and inspection (CVC §§2802–2805, and 2813).

Any officer, who has reason to believe a CMV is not safely loaded or the height, width, length, or weight of a vehicle and load is unlawful, is authorized to require the driver to stop and submit to an inspection, measurement, or weighing of the vehicle. The officer may have the driver stop in a suitable area and reload or remove any part of the load.

Any person driving a CMV over a highway or bridge illegally is liable for all damage caused to the highway or bridge. When the driver is not the owner of the vehicle but is operating it with the permission of the owner, the owner and driver may both have to pay for the damage.

State Air Emissions Rules

All commercial diesel vehicles and equipment that operate in California, even those based out of state or out-of-country, are subject to the emission requirements as specified by California Air Resources Board (CARB). To enforce these requirements, CARB is authorized to inspect all vehicles and equipment for excessive smoke, tampering, and compliance with fleet rules and issue citations with substantial penalties for non-compliance. Commercial diesel vehicle inspections are performed by CARB inspection teams at border crossings, CHP weigh stations, fleet facilities, and randomly selected roadside locations. Some key regulations are as follows:

- Truck and Bus Regulation. Be aware! Beginning in 2020, you will no longer be able to register vehicles with DMV that are not compliant with the truck and bus regulation. Regulation apply to nearly all privately and federally-owned diesel trucks and buses and

toprivately and publicly-owned school buses with a GVWR greater than (>) 14,000 pounds. Since January 1, 2012, all diesel trucks and buses that operate in California must be upgraded with a diesel particulate filter (DPF) to reduce exhaust emissions. Since January 1, 2015, lighter and older heavier diesel trucks must be replaced with 2010 model year engines or equivalent. By January 1, 2023, nearly all trucks and buses will need to have 2010 model year engines or equivalent. The regulation provides a variety of flexibility options tailored to fleets operating low use vehicles and fleets operating in select locations like agricultural and construction areas.

The regulation does provide a variety of flexibility options tailored to fleets operating low use vehicles and fleets operating in selected locations like agricultural and construction. - Emission Control Label (ECL). All diesel trucks and buses with a GVWR >6,000 pounds that have a 1974 or newer engine must have an ECL on the engine. A properly affixed and legible manufacturer ECL is required as proof that the engine meets emission standards.

- Periodic Smoke Inspection Program (PSIP). All owners of California-based fleets with 2 or more on-road diesel trucks with a GVWR > 6000 pounds for engines 4 years old and older, must annually test the opacity of these vehicles and maintain test records for a minimum of 2 years. Starting in mid-2019, trucks equipped with a DPF, regardless of engine model year, must comply with a smoke opacity limit of 5 percent. Non DPF-equipped trucks will need to comply with smoke opacity limits of 20 percent, 30 percent, or 40 percent, depending on engine model year and technology.

- Commercial Idling. All commercial diesel vehicles with a GVWR >10,001 pounds are limited to 5 minutes of non-essential idling in all areas of California. A CMV or school bus may not idle for any time at a school.

- Tractor/Trailer Greenhouse Gas (GHG). All 2011 through 2013 model-year sleeper/day-cab tractors must be SmartWay designated models. Model-year 2014 or newer tractors are covered by federal regulations.

All 53 feet or longer box trailers must be SmartWay certified or aerodynamically retrofitted to meet minimum standards of operation. - Solid Waste Control Vehicle (SWCV). All diesel trucks with a GVWR >14,000 pounds and model-year engines from 1960 to 2006 used to collect residential and commercial solid waste must clean up the exhaust from these vehicles by using particulate matter (PM) reduction technology.

- Public Agency and Utility Vehicles (PAU). All diesel vehicles with a GVWR >14,000 pounds and a 1960 through 2007 model year engine operated by a public agency or private utility must clean up the exhaust from these vehicles by using PM reduction technology.

- Transit Bus. All public transit agency fleet vehicles and urban buses with a GVWR >8,500 pounds must add retrofit DPF filters, or upgrade to equipment that meets more stringent emission standards and/or replace existing diesel vehicles with alternative-fuel vehicles.

- Transport Refrigeration Unit (TRU). All diesel fueled TRU trailers and TRU generator (gen) sets based in California must be registered with ARB, labeled with CARB Identification Number (IDN), and meet in-use standards based upon the TRU engine model-year. Additionally, only compliant TRUs and gen sets may operate in California.

- Port Truck (Drayage). All on-road Class 7 and Class 8 (GVWR >26,000 pounds) diesel trucks that transport cargo to and from California ports and intermodal rail yards, regardless of the state or country of origin, must be registered in the CARB Drayage Truck Registry (DTR) and have a 2007 model-year or newer engine.

Note: For more information on each regulation above, visit arb.ca.gov/msprog/truckstop/truckstop.htm or call 866-6DIESEL (866-634-3735).

Length of Vehicle/Loads-Single Vehicle

The maximum length for a single vehicle is 40 feet. This length may be exceeded by parts complying with fender and mudguard provisions of the CVC.

Note Some vehicles are conditionally exempted from the 40-foot maximum length (for example, semitrailers, buses, and housecars).

The front bumper of a vehicle must not extend more than 2 feet ahead of the fenders, cab, or radiator, whichever is foremost.

On a bus, a front and/or rear safety bumper may extend an additional foot, and a wheelchair lift may extend up to 18 inches ahead of the bus. Additional extensions up to 36 inches in front or 10 feet in the rear of some buses may be added to transport bicycles.

An articulated bus or trolley coach cannot exceed a length of 60 feet.

Length of Vehicle/Loads-Combination Vehicles

In a combination of vehicles, auxiliary parts or equipment, which do not provide space for carrying a load or are not used to support or carry the vehicle, may exceed the single vehicle length limit, but the combination may not exceed the length limit for combinations.

A semitrailer being towed by a motor truck or truck tractor may exceed 40 feet when certain conditions are met (CVC §35400(b) (4)).

A combination of a truck tractor and a trailer coupled together shall not exceed a total length of 65 feet except as provided in CVC §§35401 and 35401.5.

A combination of vehicles consisting of a truck tractor, semitrailer, and trailer cannot be longer than 75 feet, providing the length of either trailer does not exceed 28 feet 6 inches.

If posted, cities and counties may prohibit a combination of vehicles in excess of 60 feet in length on highways they control.

Other exceptions can be found in CVC §35401.5. Extension devices are allowed with restrictions (CVC §35402).

The load length on any vehicle or combination of vehicles may not be more than 75 feet in length measured from the front of the vehicle or load to the back of the vehicle or load.

Length Exceptions

Some length exceptions are listed below:

- If the load consists only of poles, timbers, pipes, integral structural materials, or single unit component parts, including: missile components, aircraft assemblies, drilling equipment, and tanks not exceeding 80 feet in length; provided they are being transported on one of the following:

— Pole or pipe dolly or other legal trailer used as a pole or pipe dolly pulled by a motor vehicle.

— Semitrailer.

— Semitrailer and a pole or pipe dolly, pulled by a truck tractor to haul flexible, integral, structural material (CVC §35414). - Public utilities. Refer to CVC §35414(B) for load exceptions.

- The load on any vehicle or combination of vehicles must not extend more than 3 feet beyond the foremost part of the front bumper or tires. There are exceptions for booms, masts of shovels and cranes, or water-well drilling and servicing equipment (CVC §35407). A load composed solely of vehicles may extend 4 feet ahead of front tires or the front bumper.

- The load on any single vehicle may not extend to the rear, beyond the last point of support, more than 2/3 of the length of the wheelbase of the vehicle. On a semitrailer, the wheelbase extends from the center of the last axle of the towing vehicle to the center of the last axle on the semitrailer.

Width of Vehicles and Loads

The outside width of the body of the vehicle or load must not exceed 102 inches (8 1/2 feet). The width of a vehicle with pneumatic (air-filled) tires, measured from the outside of one wheel to the outside of the opposite wheel, must not exceed 108 inches (9 feet).

Permitted devices, limited to door handles, hinges, cable cinchers, chain binders, and placard holders may extend 3 inches (6 inches on one side for vehicles used for recreational purposes) on each side of the vehicle or load.

Required devices, limited to lights, mirrors, or other devices, may extend up to 10 inches on each side.

Cities and counties may post signs on highways which they control, to permit wider vehicles, or prohibit vehicles wider than 96 inches (8 feet).

Special mobile equipment and special construction and highway maintenance equipment may not be more than 120 inches (10 feet) wide.

Motor coaches or buses may be 102 inches wide. When operated by common carriers for hire in urban or suburban service, they may be 104 inches wide.

When a vehicle is carrying loosely piled agricultural products, such as hay, straw, or leguminous plants in bulk, rather than crated, baled, boxed, or stacked, the load and racks that hold the load may be no more than 120 inches wide.

A special trip permit may be obtained from the California Department of Transportation (Caltrans) to transport trusses and similar one-piece construction components up to 12 feet wide (CVC §35780.5).

Variances for Farm Equipment

Implements of husbandry (farm equipment) are generally exempted from width and length limitations if they are operated, transported, or towed over a highway incidental to normal farming operations. Owners and operators of such equipment should refer to the CVC provisions which apply. A CalTrans transportation permit may be necessary (CVC §§36000 and 36600).

Heights of Vehicles and Loads

The vehicle height limit and/or load limit, measured from the surface of the roadway on which the vehicle stands, is 14 feet.

EXCEPTIONS:

- Double deck buses may not exceed 14 feet 3 inches.

- Farm equipment moved incidentally over a highway.

Weight Limits—General

Caltrans has authority to post signs at bridges and along state highways stating the maximum weight they will sustain. Such weight may be greater or lesser than the maximum weight limits for a vehicle specified in CVC §§35550-35557.

Counties and cities may post higher or lower weight limit signs along highways and at bridges they control. Alternate routes may be given for vehicles that are too heavy for posted highways and bridges.*

Note Weight limitations by local ordinance do not prevent CMV from entering posted streets or highways by direct route to (a) make pickups or deliveries of goods, wares, and merchandise, (b) deliver materials for bona fide construction, repair, etc. of a structure for which a permit has been obtained, or (c) make public utility construction or repairs.

Axle Weight Limits

The gross weight that can be carried by the wheels of any one end of an axle must not exceed 20,000 pounds (20,500 pounds for buses). Additionally, the load limit stated by the tire manufacturer (molded on at least 1 sidewall) shall not be exceeded.

The weight carried by the wheel or wheels on one end of an axle must not exceed 10,500 pounds. This limitation does not apply to vehicles transporting livestock (CVC §35550).

Combinations of vehicles made up of a trailer or semitrailer, and each vehicle in the combination, must meet either the weight provisions of CVC §35551 or the following:

- The gross weight placed on a highway by the wheels on any one axle of a vehicle must not exceed 18,000 pounds. The gross weight on any 1 wheel, or wheels, supporting one end of an axle and resting on a roadway must not exceed 9,500 pounds.

- EXCEPTIONS:

— The gross weight placed on a highway by the wheels on any front steering axle of a motor vehicle must not exceed 12,500 pounds.

— Vehicles carrying livestock are exempt from the gross weight limit, which applies to a wheel at one end of an axle.

A complete list of vehicles exempt from front-axle weight limits can be found in CVC §35551.5(b).

The total gross weight with load, placed on a highway by any 2 or more consecutive axles of a combination of vehicles, or vehicle in the combination, where the distance between the first and last axles of the 2 or more consecutive axles is 18 feet or less, must not exceed that given for the respective distance as shown in the table in CVC §35551.5(c).

When the distance between the first and last axles is more than 18 feet, use the table shown in CVC §35551.5(d).

Weight Limit—Logs

Weight limits for vehicles transporting logs are contained in CVC §§35552 and 35785. Such additional weight may not be transported on interstate highways.

Weight-to-Axle Ratio (CVC §35551)

Highways and bridges are designed to carry only a certain amount of weight per foot of distance between axles. Vehicles carrying heavy loads must not put too much weight on any point; the limitations are shown in the tables found in CVC §§35551 and 35551.5.

The total gross weight in pounds placed on the highway by any group of 2 or more consecutive axles must not exceed that given for the respective distance in that table.

In addition to the weight specified in the previously mentioned table, two consecutive sets of tandem axles may carry a gross weight of 34,000 pounds each, if the distance between the first and last axles of the sets of axles is 36 feet or more. The gross weight on each set of tandem axles must not exceed 34,000 pounds and the gross weight on 2 consecutive sets of tandem axles must not exceed 68,000 pounds (CVC §35551(b)).

Loading/Unloading (CVC §35553)

Load limits are not enforced when vehicles are loading or unloading in the immediate vicinity of a loading or unloading area.

A driver moving a load under a special permit may not change the route. EXCEPTION: To avoid violating a local city traffic regulation, the driver may detour the route on nonresidential streets only and return to the route as soon as possible.

Penalties for Weight Restriction Violations

A driver who changes from the permitted route for an extralegal load, without a peace officer’s authorization to do so, is guilty of a misdemeanor.

CHP Uniform Weight Standards

A standard for enforcing weight laws has been established by CHP. The standard states, “Vehicles weighing in excess of the legal limits by 100 pounds or more shall not be permitted to proceed until the overload has been adjusted or removed.”

In practice, CHP will allow for a 200 pound variation factor. After applying the variation factor, any vehicle exceeding the axle weight, axle group weight, or gross weight limits by 100 pounds or more will be issued a citation and required either to adjust the load to make it legal or obtain an overweight permit before proceeding.

Cargo containing HazMat materials may be allowed to proceed as loaded, provided unloading or load adjustment cannot be handled with reasonable safety to the driver and the public.

Livestock and field-loaded bulk perishable agricultural products destined for human consumption being transported from the field to the first point of processing have a special exemption. Drivers of vehicles transporting livestock and perishable agricultural products will be cited and allowed to proceed as long as the weight does not exceed legal limits by 1,000 pounds on any axle or axle group of a single truck, or 2,000 pounds gross weight on a combination of vehicles.

Permits

Transporting an oversize extralegal load without a permit is punishable by a fine, jail time, or both. Excess load penalties may also be imposed.

It is against the law in California to drive or move, on any street or highway, any vehicle that is wider, higher, or heavier than the limits described here. Permits for oversized vehicles may be obtained from:

- Caltrans–for state highways.

- The city or county–for city or county highways.

Motor Carrier Permits

Any person who operates any CMV either for hire or privately (not for hire) must obtain a motor carrier permit (MCP) (CVC §34620).

The MCP definition for a CMV is any:

- Self-propelled vehicle listed in CVC §§34500(a), (b), (f), (g), and (k).

- Motor truck with 2 or more axles weighing more than 10,000 pounds GVWR.

- Other motor vehicle used to transport property for hire.

Note: An MCP CMV does not include vehicles operated by household goods carriers (California Public Utilities Commission (CPUC §5109)), pickup trucks (CVC §471), or 2-axle daily rental trucks (noncommercial use) weighing less than 26,001 pounds gross.

To obtain MCP forms and information, visit dmv.ca.gov, write, or call:

Department of Motor Vehicles

Motor Carrier Permit Operations, MS H875

PO Box 932370

Sacramento, CA 94232–3700

(916) 657-8153

Unified Carrier Registration (URC)

Interstate or foreign motor carriers transporting property must obtain UCR, as outlined in the final regulations issued by the Federal Unified Carrier Registration Act of 2005. UCR fees can be paid online at plan.ucr.gov.

To obtain UCR forms and information, visit dmv.ca.gov, write, or call:

Department of Motor Vehicles

Motor Carrier Permit Operations, MS H875

PO Box 932370

Sacramento, CA 94232-3700

(916) 657-8153

Speed Limits

The maximum speed limit in California is 55 mph for the following vehicles (CVC §22406):

- A truck or truck tractor having 3 or more axles.

- A vehicle pulling any other vehicle.

- A school bus transporting any pupil.

- A farm labor vehicle transporting passengers.

- Any vehicle transporting explosives.

- A trailer bus.

For all other vehicles, the maximum speed limit on most California highways is 65 mph. However, for 2-lane undivided highways, the maximum speed limit is 55 mph, unless a higher speed limit is posted. On some highways, the maximum speed limit is 70 mph, but only if there are signs posted showing 70 mph.

No person shall drive at such a slow speed as to impede or block normal and reasonable movement of traffic, except when reduced speed is necessary for safe operation, for compliance with the law, or when the size and weight of the vehicle or combination makes reduced speed unavoidable.

Right Lane Rule

Vehicles listed in CVC §22406 must be driven in the designated lane or lanes when signs are posted.

When no signs are posted, these vehicles must be driven in the right-hand traffic lane or as close as possible to the right edge or curb. On a divided highway with 4 or more traffic lanes in one direction, these vehicles may also be driven in the lane just to the left of the right-hand lane. When overtaking or passing another vehicle going in the same direction, drivers of such vehicles must use either: (1) the designated lane, (2) the lane just to the left of the right-hand lane, or (3) the right-hand traffic lane when such use is permitted.

Designated System Access

Designated system access does not apply to a driver who is either: (1) preparing for a left- or right-hand turn, (2) in the process of entering or exiting a highway, (3) driving in a lane other than the right-hand lane “to continue on the intended route.”

Buses, except school buses or trailer buses, may drive in any lane as long as they are not towing another vehicle.

Movement off or onto the designated system (freeways/highways) by larger trucks is allowed only at interchanges or exits, which have the following signs:

- Movement is allowed along signed routes to reach terminals. Terminals are locations where:

— Freight is consolidated.

— Full loads are off-loaded.

— Vehicle combinations are regularly maintained, stored, or manufactured.

- Movement is allowed up to 1 mile from the identified exit or entrances leading to or from specified highways to obtain:

— Food

— Fuel

— Lodging

— Repairs

Slow Vehicle Rule

On a 2-lane highway where passing is unsafe, a slow-moving vehicle with 5 or more vehicle behind it must turn off the roadway at the nearest place designated by signs as a turnout, or wherever sufficient area for a safe turnout exists, to let the following vehicles pass.

Hours of Service

You are required to comply with California’s driver hours of service regulations when you are involved in INTRAstate commerce. You are considered to be involved in intrastate commerce when you do not:

- Cross the state line.

- Transport cargo which originated from another state.

- Transport cargo destined outside of California.

- Transport any hazardous substance or waste (CFR, Title 49 §171.8).

Other Rules

You are required to comply with federal driver hours of service regulations when you are involved in INTERstate commerce. You are considered to be involved in interstate commerce when the cargo you transport:

- Originates out of state.

- Is destined out of state.

- Consists of hazardous substances or wastes (CFR, Title 49 §171.8).

- Any combination of the above.

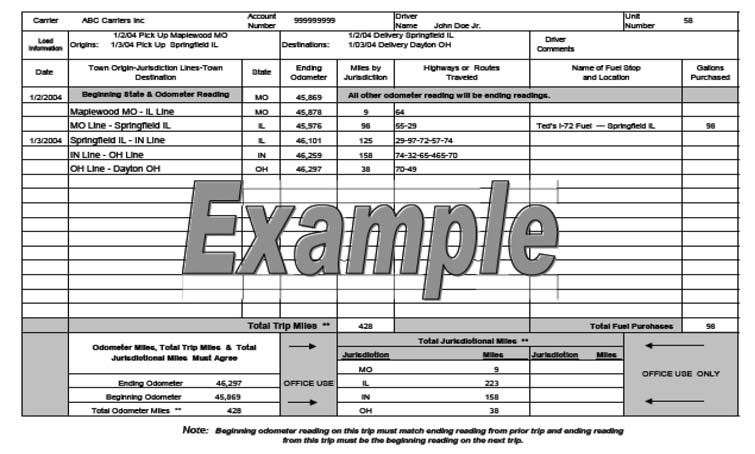

Driver’s Record of Duty Status

CHP is authorized to develop additional safety and driving regulations (CVC §§34501 and 34501.2).

A driver’s record of duty status must be used to record all of the driver’s hours. Drivers of CMVs must be in compliance with the hours of service requirements of the CFR, Title 49 §395.8 and the California Code of Regulations (CCR), Title 13 §§1201–1213.

A driver’s record of duty status must be kept in duplicate by each driver and each co-driver while driving, on duty but not driving, or resting in a sleeper berth. The record of duty status must be presented for inspection immediately upon request by any authorized CHP employee, any regularly employed and salaried police officer, or deputy sheriff. There may be instances when you do not need to maintain a record of duty status.