19.090 Vehicle Safety System Inspection Program

(Business and Professions Code, Sec. 9, Article 6.5 Vehicle Safety Systems Inspection, 9888.6, Vehicle Code §11519)

Changes to DMV Virtual Clerk System (utilized by Business Partner Automation [BPA] Program participants) were implemented to allow an inquiry to the Department of Consumer Affairs, and the Bureau of Automotive Repair (BAR) Vehicle Safety System Inspection (VSSI) database. A link between Virtual Clerk System and BAR was established to verify VSSI certificate status when processing specified transactions.

Continue to follow existing procedures in this chapter when reregistering vehicles that have been declared junk, salvage, or transactions requiring a VSSI.

If the below error messages are displayed in Virtual Clerk, BPA program participants should contact their First Line Service Provider (FLSP) for guidance.

- D447 BAR SAFETY SYSTEMS CERTIFICATE OF COMPLIANCE REQUIRED

Note Transactions may proceed if the D447 error message displays and RDF is selected. - Q023 CNA – SHORT TERM (BAR SAFETY SYSTEMS CERTIFICATE OF COMPLIANCE)

Transactions impacted by the changes are limited to the following.

- C10/C11 – Revived Junk/Revived Salvage (Original/Clearing)

- F00/F01 – Transfer of Registered Owner/Revived Salvage with CA Title/Clearing

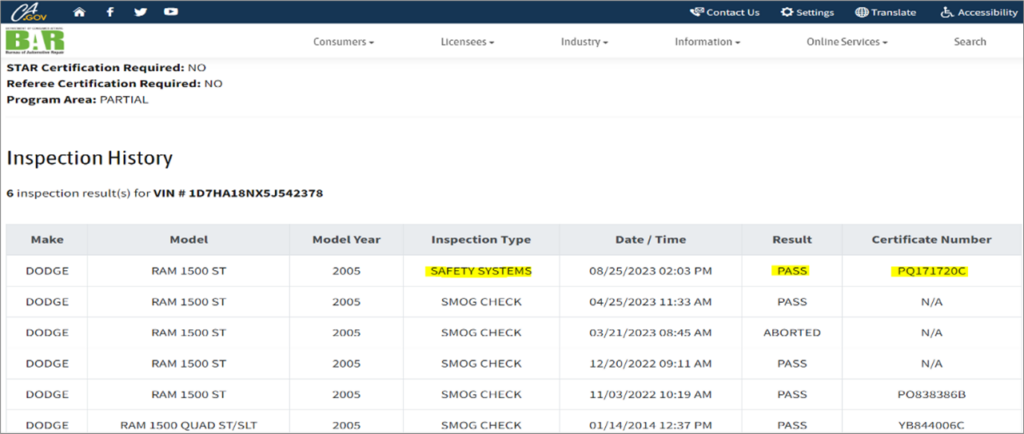

Transactions completed with a valid VSSI will need to include a “BAR Inspection History” screen print in the clearing transaction (see Figure 1 below). One “PASS” VSSI must display a “Certificate number” on the BAR Inspection History screen print and replaces both the brake/light certificates. VSSI test results can be found on the BAR website: bar.ca.gov/inspection

Figure 1 – BAR Inspection History

Important:

- Paper certificates issued on and after September 28, 2024, will not be accepted.

- If the originating transaction is dated on or before December 26, 2024, and a paper brake/light certificate is presented, BPA participants must contact their FLSP for guidance.

- The VSSI Certificate exemption, due to distance from an inspection facility, is being discontinued. A Statement of Facts (REG 256) from an automotive repair shop attesting to the vehicle safety systems requirements, are no longer accepted.

- Trailers with a manufacturer’s GVWR under 3,000 lbs. are exempt from VSSI requirements. BPA participants must contact their FLSP for guidance.

- VSSI history can be found on the BAR website: www.bar.ca.gov/inspection. Key in the vehicle identification number (VIN) for the most accurate results; query using the vehicle license plate number is discouraged given that it can change. A “PASS” VSSI result must display a “Certificate number” on the BAR Inspection History screen print.

- VSSI and Smog Inspection history can be found on the same weibste, however, each program and registration clearing requirements will vary.

- VSSI test results are not available (on the BAR website) for inspections completed the same day. However, VSSI inspection results can be verified electronically with the BAR query and are available immediately (upon inspection completion).

- One “Pass” electronic VSSI certificate, issued by BAR, replaces both the brake and light certificates.

10.035 Emission Compliance for Heavy Duty Vehicles (VC §§4000.15, 4156.5 (c)(2),(e)(1), and 9257.5)

Emission Compliance for Heavy Duty Vehicles

Changes to the DMV Virtual Clerk system (utilized by Business Partner Automation [BPA] Program participants) were implemented to verify heavy-duty vehicles with a manufacturer’s gross vehicle weight rating (GVWR) over 14,000 pounds comply with California Air Resources Board (CARB) emission standards. DMV will confirm compliance electronically, as identified by CARB, and deny the vehicle registration renewal or transfer of non-compliant vehicles.

- If the below error messages are displayed in Virtual Clerk, BPA program participants should contact their First Line Service Provider for guidance.

- Q212 WARNING CARB NON-COMPLIANT (HDIM)

- Q023 CNA SHORT TERM (VINTELLIGENCE)

- D444 DB2 LOOKUP FAILED (CARB ELIGIBILITY / COMPLIANCE)

- Transactions impacted by the changes are limited to the following.

- C10/C11 Revived Junk/Revived Salvage (Original/Clearing)

- F00/F01 Transfer of Registered Owner/Transfer of RO/Revived Salvage Clearing

- F10/F11 Transfer of Legal Owner (LO)/Clearing

- H00/H01 Stickers/Plates/Renewal/Registration Cards/Clearing

- J00/J01 Duplicate Owner Certificate/Clearing

- When there are no renewal fees due the system will perform a compliance check on eligible vehicles but will not perform a hard stop on:

- Replacement indicia only transactions, such as:

- Title replacement.

- Plates replacement.

- Stickers replacement.

- Registration replacement.

- Metal tab replacement.

- Vehicles on PNO for all impacted TTCs except for F00/F01.

- Replacement indicia only transactions, such as:

Note Changes have been made to allow transfers for CARB non-compliant vehicles that are unrecovered stolen vehicles being transferred to an insurance company or registered out of state.

7.060 Hard-Top Racers VC §4000

Hard-top racers, midget auto racers, and other vehicles of this type are subject to registration if moved upon a highway with any wheel in contact with the road.

7.055 Half-Track Vehicles

Half-track vehicles are motor vehicles with conventional front wheels and caterpillar tracks and gears in place of rear wheels. Half-track vehicles shall be considered to have one-half as many axles as there are wheels supporting the vehicle’s weight and its load. Make Abbreviation Make Abbreviation Autocar AUTKT Mack MCKKT Diamond DMDKT Peterbilt PETKT International INTKT White WHIKT Kenworth KENKT White Freightliner WFTKT

7.050 Government Surplus Vehicles (GSVs) (VC §4000)

Suspense all applications for vehicles sold by the U.S. government to the Registration Suspense Processing Unit at DMV headquarters when using type transaction code (TTC) G40 or C00.

There are three different types of government surplus vehicles (GSVs):

- GSVs – Can be from any federal agency except the military. Most of these vehicles are complying and have:

- A 17-digit vehicle identification number (VIN).

An emission label.

A Federal Motor Vehicle Safety Standard (FMVSS) label.

- A 17-digit vehicle identification number (VIN).

- Military Vehicles (Humvees)—Are usually sold through auctions and cannot be registered for on-highway use. However, they may be registered for off-highway use if written on the United States Government Certification to Obtain Title to a Vehicle (SF 97-1) form.

- These vehicles will not have:

A 17-digit VIN but will have a serial number.

A secondary or alternate VIN.

An emission label.

An FMVSS label.

- These vehicles will not have:

- Tactical Vehicles

Are military vehicles except they have a U.S. Department of Defense (DOD) Defense Logistics Agency (DLA) Certificate to Register a Tactical Vehicle (DLA 1928) form. These vehicles can be registered for on-highway use, only when an exempt agency is using these vehicles for defense exercises. The U.S. government remains the lien holder on these vehicles. Tactical vehicles will not have:

- A 17-digit VIN but will have a serial number.

A secondary or alternate VIN. - An emission label.

- An FMVSS label.

To register a surplus vehicle sold by the U.S. government the applicant must submit:

- A completed Application for Title or Registration (REG 343) form.

- A Verification of Vehicle (REG 31) form.

- A Certificate of Release of Motor Vehicle (U.S. Government Standard Form 97) and any bills of sale needed to establish a complete chain of ownership.

- A weight certificate for a commercial vehicle weighing less than 10,001 pounds, unladen. If the vehicle is operated over 10,000 pounds gross vehicle weight (GVW) or is a permanent trailer identification (PTI) trailer, the estimated weight may be shown on a Statement of Facts (REG 256) form.

- Declaration of Gross Vehicle Weight (GVW)/Combine Gross Vehicle Weight (CGW) (REG 4008) form for a commercial vehicle over 6,001 pounds unladen, except pickups.

- A smog certification, if appropriate.

- Vehicle/Vessel Transfer and Reassignment Form (REG 262) for Odometer Disclosure Statement, if applicable.

- Fees due. Refer to Chapter 28 for Use Tax information. GSVs • For titling purposes, these vehicles must have an SF 97-1. Military Vehicles

- Do not accept a REG 31 from anyone except DMV. If DMV is unable to find the serial number, refer the customer to the California Highway Patrol (CHP).

- Note Unless the serial number is disfigured or missing, do not refer these vehicles to CHP.

- Customers will have an SF 97-1 in lieu of titling documents. If the SF 97-1 is lost, the customer must get a duplicate from the auction. If the auction cannot provide a duplicate, they must provide the contact information of the federal government agency where one can be obtained.

- Suspense all transactions for military vehicles (Humvees) to the Technical Compliance Section (TCS) at DMV headquarters. Tactical Vehicles

- Do not accept a REG 31 from anyone except DMV. If serial number cannot be found, refer applicant to CHP.

- Do not confuse tactical vehicles with GSVs. GSVs come from different federal agencies and are usually compliant vehicles with a 17-digit VIN, an emission label, and an FMVSS label.

7.045 Golf Carts (VC §§345, 21115, 21115.1, and 21716)

Golf carts are motor vehicles designed to do all the following:

- Carry golf equipment.

- Carry no more than two persons, including the driver.

- Have at least three wheels in contact with the ground.

- Weigh no more than 1,300 pounds unladen.

- Not exceed a speed of 15 miles per hour (mph). Golf carts may not be operated on any highway with a posted speed limit of over 25 mph, except by ordinance or resolution by a local authority (such as city or county government).

Note Golf carts weighing more than 1,300 pounds cannot be registered as a golf cart and are considered to be a regular motor vehicle which must comply with Federal Motor Vehicle Safety Standards (FMVSS) and California emissions standards.

On-Road Use—The applicant must submit:

- A completed Application for Title or Registration (REG 343) form.

- The California Certificate of Title, manufacturer’s certificate/statement of origin, bill of sale, or other acceptable documents to establish the chain of ownership.

- A Verification of Vehicle (REG 31) form.

- A Statement of Facts (REG 256) form signed by the vehicle owner or an authorized representative indicating the vehicle:

- Has not been modified.

- Meets the definition of a golf cart as defined in VC §345.

- Fees must:

- Assign the body type model (BTM) of “GC” for golf cart.

Note Electric and gasoline-powered golf carts are exempt from emissions testing; however, gasoline-powered golf carts are not exempt from California Air Resources Board (ARB) emission requirements. The REG 31 must indicate the golf cart has a label certifying compliance with California emission requirements for on-road use. Without this compliance label, the golf cart can only be registered for off-highway use.

Modified Golf Carts—If the golf cart is modified to travel more than 15 mph or carry more than two persons (including the driver), the vehicle is considered to be a regular motor vehicle and must comply with the FMVSS for a regular passenger motor vehicle.

Golf carts operated for a distance not exceeding one mile from a golf course on a highway designated for such operation by ordinance or resolution are exempt from registration. If a golf cart becomes subject to registration, the registration requirements are the same as for an original or nonresident motor vehicle.

7.040 Go-Carts

Vehicles commonly referred to as “go-carts” that meet emission and requirements for off-highway vehicle (OHV) registration may be registered as an OHV.

7.035 Forklift Trucks (VC §4013)

Any forklift truck that is designed primarily for loading, unloading, and stacking materials, which is operated or drawn upon a highway only to transport products or materials across a highway in the loading, unloading, or stacking process, and which is not operated along a highway for a distance greater than one-quarter mile, is exempt from registration.

Registration Required—A forklift truck operated along a highway for a distance greater than one-quarter mile is subject to registration as follows:

| If the Vehicle Is Moved | Then |

| Laden | Commercial registration is required. |

| Unladen | Automobile registration is required. The vehicle is exempt from the weight fee (VC §9409). The application must include a Statement of Facts (REG 256) form from the owner stating the vehicle will not be moved laden over the highways to qualify for the weight fee exemption. |

7.030 Exemptions From Registration

The following vehicles are exempt from regular registration but may be required to display special identification (ID), as shown:

Aircraft Refueling Vehicles (Vehicle Code [VC] §4021)—Any vehicle designed or altered and used exclusively for the refueling of aircraft at a public airport, operated upon a highway, under the control of a local authority, for a continuous distance not exceeding one-quarter mile each way to and from a bulk fuel storage facility.

Cemetery Equipment (VC §§4012 and 5011)—Any vehicle, implement, or equipment specifically designed or altered for and used exclusively in the maintenance or operation of cemetery grounds, which is only incidentally operated or moved on a highway. Cemetery equipment must display a special ID plate if moved over a highway.

Disaster Relief Vehicles (VC §4005)—Any vehicle operated within a disaster area or region, for the purpose of assisting in disaster relief work, under a special permit issued by the department for that purpose. The special permit is issued only if the California Department of Transportation (CALTRANS), or the responsible local authority, has determined that the vehicle is necessary for such purpose and is valid only during a period of a state of emergency, as proclaimed by the Governor under the provisions of the California Emergency Services Act.

Firefighting Equipment (VC §4015)—Any privately-owned vehicle designed or capable of being used for firefighting purposes and only operated upon a highway in responding to, or returning from, emergency fire calls. This includes fire fighting vehicles which are privately-owned and operated by an all-volunteer, nonprofit fire department in an unincorporated area. Vehicles that do not qualify under VC §4015 must be registered.

The California Code of Regulations, Title 13 §157.00 defines fire fighting vehicles as:

(a) A fire fighting vehicle is defined as any vehicle that contains firefighting apparatus and equipment, which is designed and intended primarily for firefighting. The following privately-owned vehicles, when operated upon a highway only in responding to, and returning from, emergency fire calls qualify as fire fighting vehicles and are exempt from registration:

- Fire trucks equipped with hose and ladders.

- Fire engines.

- Other vehicles permanently equipped with firefighting apparatus and equipment.

- A tank truck operated solely in conjunction with a fire truck, fire engine, or other self-propelled firefighting apparatus.

(b) Privately-owned vehicles or a combination of vehicles, which are not designed primarily for firefighting, including hazardous materials response vehicles, dedicated rescue vehicles, command post communications vehicles, passenger vehicles, buses, mobile kitchens, mobile sanitation facilities, and heavy equipment transport vehicles do not qualify as fire fighting vehicles as defined under subdivision (a) of this section.

An Authorized Emergency Vehicle permit issued by the California Highway Patrol (CHP) must be obtained if Code 3 equipment (red light and siren) is installed on a privately-owned fire fighting vehicle.

Forklift Trucks (VC §4013)—Any forklift truck which is designed primarily for loading, unloading, and stacking materials that is operated upon the highway only for the purpose of transporting products or material across a highway in the loading, unloading, or stacking process, and which is not operated along a highway for a distance greater than one-quarter mile.

Golf Carts (VC §§345 and 4019)—A motor vehicle designed to carry golf equipment and not more than two persons, including the driver. A golf cart has not less than three wheels in contact with the ground, an unladen weight of no more than 1,300 pounds, and is designed and operated at not more than 15 miles per hour. A golf cart operated pursuant to VC §21115 is exempt from registration.

If the vehicle is moved, then laden commercial registration is required. Unladen automobile registration is required. The vehicle is exempt from the weight fee (VC §9409). The application must include a Statement of Facts (REG 256) form from the owner stating the vehicle will not be moved laden over the highways to qualify for the weight fee exemption.

Hauled Vehicles (VC §4009)—A vehicle transported upon a highway, no part of which is in contact with the highway.

Logging Vehicles (VC §§4018 and 5011)—Any logging vehicle is exempt from registration but must display a special ID plate if moved over a highway.

Self-Propelled Wheelchairs, Invalid Tricycles, or Quadricycles (VC §467)—A self-propelled wheelchair, invalid tricycle, or quadricycle, while being operated by a person who, by reason of physical disabilities, is otherwise unable to move about as a pedestrian.

Snowmobiles (VC §557)—A motor vehicle designed to travel over ice or snow in whole or in part on skis, belts, cleats, or low-pressure tires. Refer to Chapter 30 for off-highway vehicle registration information. Special Equipment (VC §§565, 575, 4010, and 5011)—Special construction equipment and special mobile equipment are exempt from registration but must display a special ID plate if moved over a highway.

7.025 Exemptions From Fees (Full or Partial)

Native American-Owned Vehicles

The exemptions are:

- Vehicles owned or leased by California Native American tribes and/or tribal members who live on a federal Native American reservation or rancheria located in California and operated on or off the public highway are exempt from the vehicle license fee (VLF) portion of registration fees. A Miscellaneous Certifications (REG 256A) form with the Native American Certifications section completed and signed by a representative of the tribe or the United States Bureau of Indian Affairs must be submitted with the application.

- Vehicles registered in a federally-recognized Native American tribes name and used exclusively within the boundaries and jurisdiction of the tribe are exempt from all fees except the registration fee. A completed REG 256A or letter written on Native American tribes letterhead must be submitted with the application. The letter must be signed by an authorized tribal council member, such as the tribal chief or secretary, identify the vehicle, state it is owned by and registered in the federally recognized Native American tribes name, and will be used exclusively within the boundaries of Native American tribal land, including any incidental operation on the highways within those boundaries (VC §9104.5 and CR&TC §10781.1).

- Native American-owned trailer coaches (CCH) located on a federal Native American reservation or rancheria in California are exempt from all fees. A new CCH purchased by Native American that will not be registered may be moved to the reservation by a licensed transporter or the dealer-on-dealer license plates prior to the sale. A title only may be issued.

NATO Members—A member of a force or civilian component of the North Atlantic Treaty Organization (NATO) who is not a citizen of the United States is exempt from the VLF. A North Atlantic Treaty Organization (NATO) Status of Forces Agreement (REG 5046) form must be submitted with the application. The applicant’s identification (ID) must be verified if the REG 5046 is presented in person.

Nonresident Military (NRM) Personnel— Any nonresident owner of a vehicle registered in a foreign state and a member of the U.S. armed forces or spouse of a member of the U.S. armed forces on active duty within this state. Any person on continuous active duty in the Air Force, Army, Navy, Marines or Coast Guard is considered military personnel. This does not include civilian personnel employed by a branch of the armed forces. NRM personnel or spouse stationed in California are exempt from the VLF. A Nonresident Military (NRM) Exemption Statement (REG 5045) form must be submitted with the application. The applicant’s ID must be verified if the REG 5045 is presented in person. Specialized Transportation Vehicles (STVs) (Vehicle Code [VC] §9107)—STVs are purchased with federal funds, by public or private nonprofit specialized transportation service agencies, for the purpose of providing transportation services for senior citizens and/or handicapped persons. STVs are subject only to the annual registration fee (including miscellaneous county and law enforcement fees) and are exempt from VLF and weight fees. The application must include a Specialized Transportation Vehicle Exemption Certification (REG 345) form.